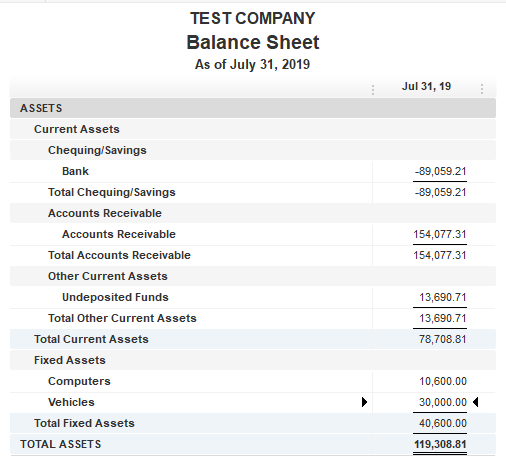

The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid. This is needed to completely remove all traces of an asset from the balance sheet known as derecognition.

How Do I Remove A Fixed Asset An Old Vehicle That

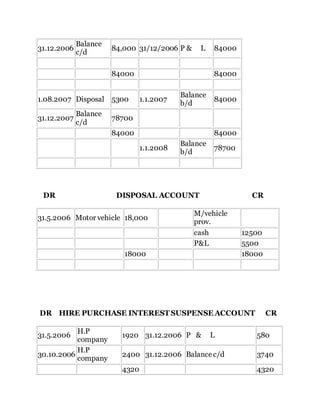

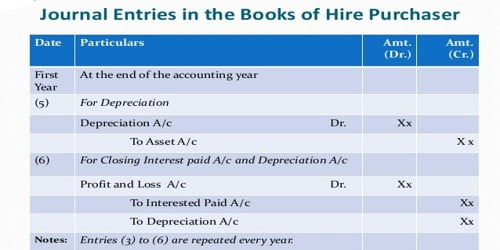

There are four methods of accounting for hire purchase.

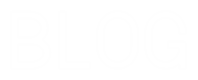

. The accounting entries would be as follows. Provision for depreciation ac. Amount Owing to Director Current Liabity Cr.

Entries in Interest Account Depreciation Account and Profit Loss Account will be the same. The purpose of this entry is to transfer the cost of the fixed asset to the asset disposal account. You record the motor vehicle in your accounting as a 15000 asset.

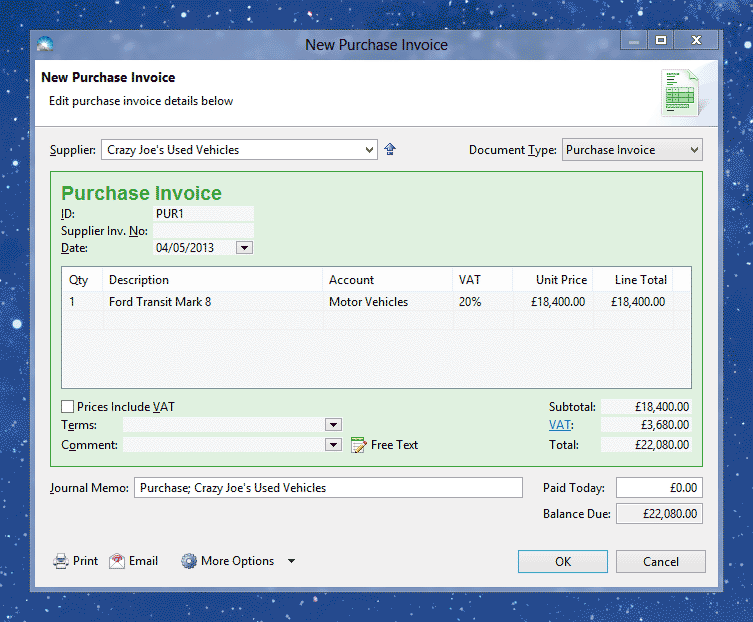

Hire Purchase ABC. If the cash price was 7000 plus 1225 of VAT which was reclaimed as input tax the double entry is. Disposal Value If an asset is disposed.

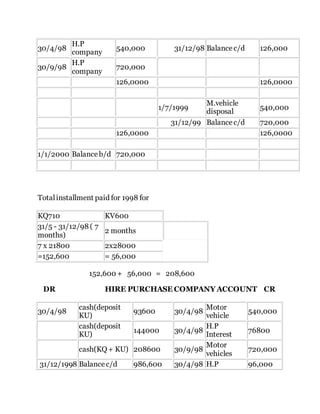

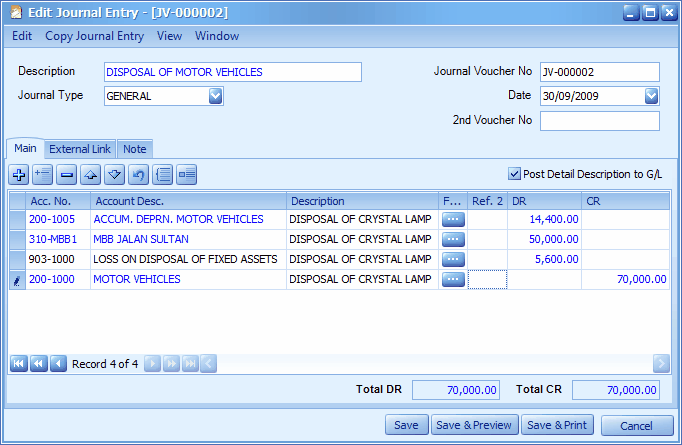

Depn 0140 Disposals 0240 Cash at bank receipts 0163. I now need to record the sale of the Hire Purchase in MYOB. The double entry for the part exchange value is.

Original cost 6349500 Motor Vehicles Sale price 6060000 inc 1010000 VAT Acc Dep 1269900 Outstanding Finance 5013113 HIre. Disposal on fixed assets refers to the write-off or sale of fixed assets and in some circumstances the assets are exchanged for new assets. Sale of Motor Vehicle on Hire Purchase.

Debit Car 70000. You are acquiring a motor vehicle that costs RM17500000. When I pay the down payment Debit Account payable 20000.

New Van 5000000. DR BS Motor Vehicles 7000. Motor vehicles cost 0130 Motor vehicles acc.

Under cash price method we are deal hire purchase transactions just like normal transactions. You create both the Interest in Suspense and Hire Purchase account as a Long-Term Liability since the payment term is more than a year. This article demonstrates how you can record a hire purchase transaction of an asset with monthly instalment.

The date of disposal of an asset is the date when the asset is sold discarded or destroyed or ceased to be used for the purposes of the business. To offset the Fixed Asset Account. He has a HP agreement on which he pays installments of.

An asset disposal may require the recording of a gain or loss on the. Deposit Paid Current Assets Cr. CR BS HP Liabilities 7000.

Old Van 1500000 this removes the old van Debit. I have recorded the sale of the vehicle with depreciation and loss already. Motor Vehicle ABC XXXX Fixed Asset Dr.

Road Tax Insurance Expenses Cr. When the hire purchase has been approved. The journal entries for the illustration number 3 given above under this method will be as under.

First we need to. DR Disposal Of Motor Vehicle Account. Show all the accounting entries for.

A and company ABC have made the hire purchase agreement of the car. A fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on an old vehicle. Accumulated Depreciation 1000000.

Assuming you purchase a new Office Equipment at 20000 and financed it with a Hire Purchase plan. The asset account may be named vehicles or something more specific such as pick-up trucks You. I am preparing the accounts for a client using his previous accountants bookkeeping.

Thus we can distinguish the disposals in 3 main. The figures are as follows. Hire Purchase double entry.

Hi Can anyone guide me what is the accounting double entry for selling of Fixed Asset - A Car.

Accounting For Hire Purchase Accounting Education

Accounting Methods Of Recording Hire Purchase Transactions Assignment Point

Hire Purchase Accounts Ppt Download

How To Record A Hire Purchase Agreement Solar Accounts Help

Fixed Assets Asset Disposal Ppt Video Online Download

Fixed Asset Trade In Double Entry Bookkeeping

How Do I Remove A Fixed Asset An Old Vehicle That

Hire Purchase System Part I Wikieducator

Hire Purchase Accounts Hire Purchase N Hire Purchase

Igcse Gcse Accounts Understand How To Record The Disposal Of Final Fixed Assets Youtube

Solved Journal Entries For Fixed Asset Sale Vehicle With

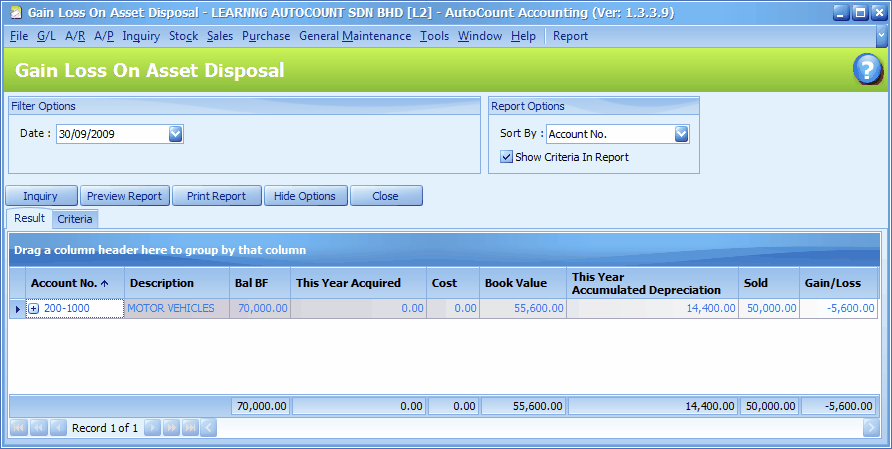

Autocount Accounting Help File 2009

Hire Purchase Accounts Ppt Download

Autocount Accounting Help File 2009

Accounting Entries For Disposal With Part Exchange Youtube

Hire Purchase Accounts Hire Purchase N Hire Purchase